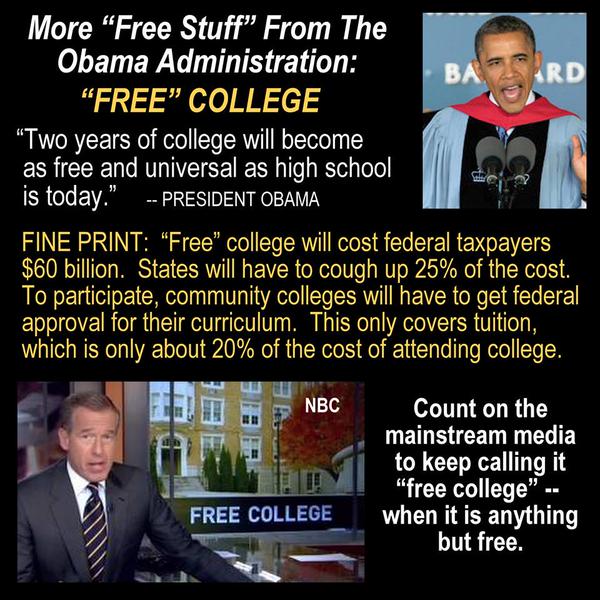

Obama’s Latest Brainstorm of ‘More Free Stuff’

Obama’s Latest Brainstorm of ‘More Free Stuff’

Image: Joe Thompson@Twitter

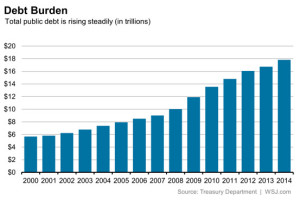

(CNN) The most compelling reason to save for your child’s college education in a 529 Plan has been for the tax savings–One can sock away up to $14,000 a year according to the IRS (which one of course pays taxes on when earned) for a child’s college costs and pay no capital gains taxes on the interest when the funds are used to pay for educational costs–Well that’s the plan now unless Obama has his way.

Obama’s latest brainstorm: To strip away 529 College Saving Plans of their key tax breaks–Savings would still be tax deferred but withdrawals on any new deposits made into the 529’s would be taxed as ordinary income to the beneficiary (actually double taxed as one pays income taxes on the money earned before socking it away into a 529 account) Still, why remove the incentive to sock away money to pay for a child’s future education costs?

To the Obama Administration its all about ‘fairness’ (fair for who? Who decides what is fair? Obama?) adding that tax-free distribution of money from 529 accounts unfairly benefits high income earners.

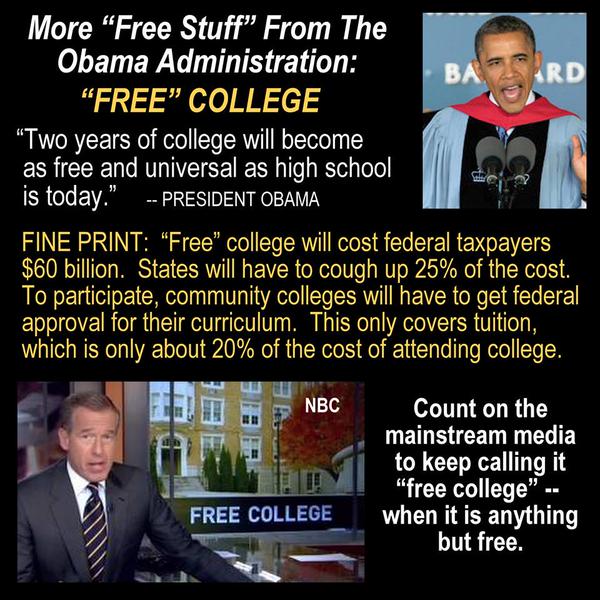

Under Obama’s proposal, one must disincentivize college savings and investment to make children dependent on the government (taxpayers) for their future educational costs.

The Wall Street Journal reports that a Senior Obama Administration official said, “Under the president’s plan, every dollar saved from consolidating and curbing inefficient tax breaks and tens of billions more–is plowed right back into higher education tax benefits for students and middle-class families. In particular, families with incomes of up to $180,000 (Obama’s latest definition of who is rich) will be able to benefit from the expanded Opportunity Tax Credit.”

This so called, ‘Opportunity Tax Credit’ provides more benefit to lower income students, in part because it pays ‘cash’ to students who don’t make enough to pay income taxes.

So let me see if I have this straight. Obama now wants to allow the government to tax (confiscate) interest earned in ‘529 College Saving Plans’ (which one has already paid federal and state income taxes on the money earned before socking funds away for a child’s future college costs) in an effort to be ‘Fair’ to lower income Americans that will qualify for an ‘Opportunity Tax Credit’ paying them tax-free cash to help pay their educational costs.

Whatever happened to Obama’s ‘firm pledge’ not to raise taxes on families earning less than $250,000 annually?

Flashback Video: Remember in 2008 when then presidential candidate Sen. Obama claimed in Dover, New Hampshire:

“I can make a firm pledge. Under my plan, no family making less than $250,000 a year will see any form of tax increase. Not your income taxes, not your payroll taxes, not your capital gains taxes, not any of your taxes.”

It sounds like its time to roll-over monies saved in 529’s while children are still young and one intends to continue to save for their future college costs for some years to come, into some other investment vehicle — Tax free municipals are looking better-and-better all the time.

Related: Obama Calls for $320 Billion in New Taxes –ATR

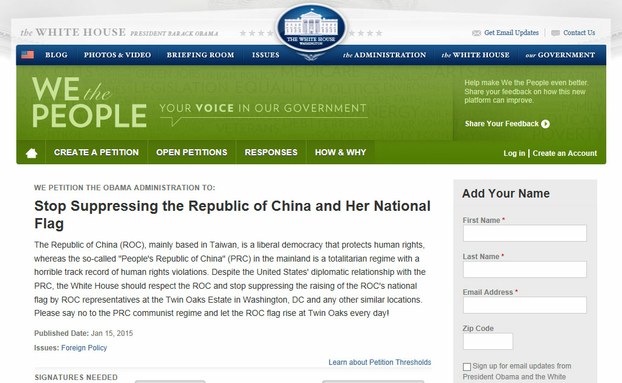

(RFA Chinese) Human Rights Activists Petition the White House

(RFA Chinese) Human Rights Activists Petition the White House Su Changlan, China Guangdong Human Rights Activist

Su Changlan, China Guangdong Human Rights Activist

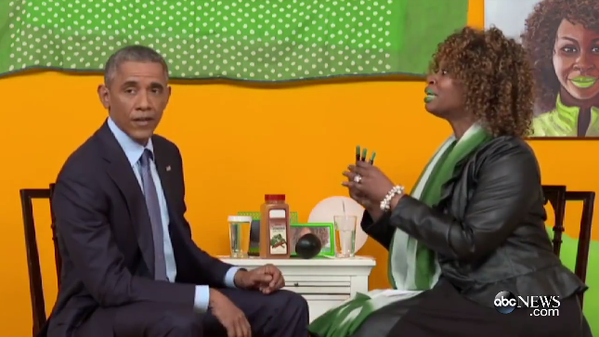

Disgusting: GloZell Eats Cereal from Bathtube –Images:

Disgusting: GloZell Eats Cereal from Bathtube –Images:

Obama’s Latest Brainstorm of ‘More Free Stuff’

Obama’s Latest Brainstorm of ‘More Free Stuff’

Video Flashback: Remember in 2008 when Sen. Obama claimed adding

Video Flashback: Remember in 2008 when Sen. Obama claimed adding (WFB Video) NBC’s Richard Engle Blasts Obama’s

(WFB Video) NBC’s Richard Engle Blasts Obama’s Wow! 1,000,000 Rosaries to End Abortion

Wow! 1,000,000 Rosaries to End Abortion