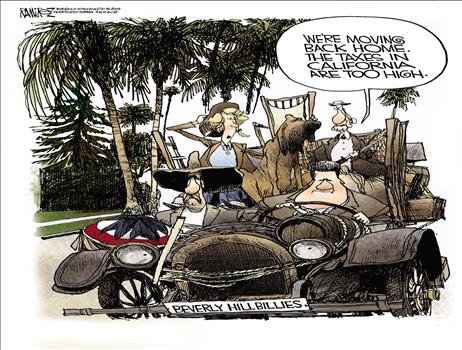

California Taxes –Asian Conservatives

California Taxes –Asian Conservatives

(Capitol Alert) Thanks to the passage of Prop 30 last month, job creators in California will pay the nations highest marginal income tax rate of 51.9% should President Obama and Congress fail to do the job(s) they were elected to do and avoid the fiscal cliff according to a new study.

Gerald Prante, an Economics Professor at Lynchburg College in Virgina together with Austin John a Lynchburg Economics student calculated marginal tax rates–the highest tax rates for all 50 states–they combined state and federal and where applicable local municipality incomes taxes, plus other miscellaneous taxes such as payroll taxes for social security, medicare, etc.

Prop 30 added 3% to the marginal tax rate in California for the highest income taxpayers bringing it to 13.3%–the action raised California over other high taxed states to a marginal rate of 51.9% slightly higher than New York City’s level.

On the 15 November Prante and John’s report was published by the Social Science Research Network.

Related: Reality Check on Fiscal Cliffs –Tea Party Patriots

Detroit Councilwoman to Obama: We Voted For You–Give Us Our Bacon

Tweet